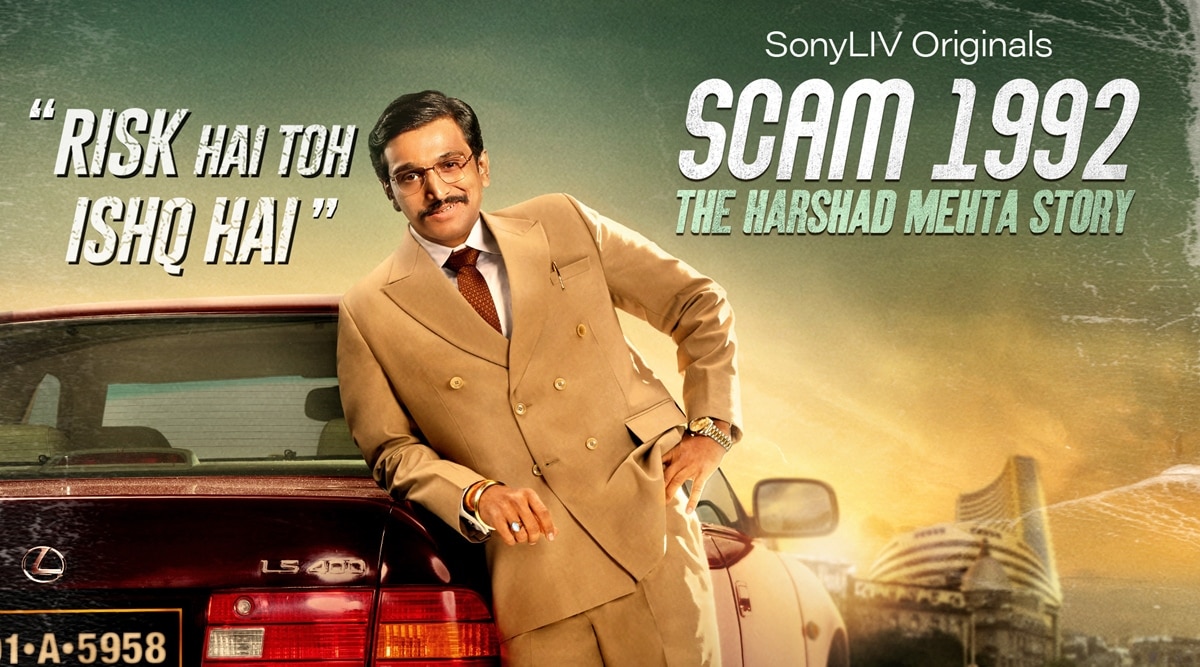

Scam 1992: The Harshad Mehta Story (Series)

Scam 1992: The Harshad Mehta Story

The 1992 Scam saw the Indian market collapse completely as the stock prices dropped dramatically, whipping out over Rs. 1 lakh crore in market capitalization.

Over 70 criminal cases and 600 civil cases were filed against Harshad Mehta and his family.

In order to truly understand this scam, it is of utmost importance to understand how the stock market and money market function. A scam of this stature isn't possible for a single person to commit. It occurs through collective engagement and collaboration. Thus, to blame Harshad Mehta as the only accused is fallacious. Hence, this dishonest series of events is known as The Scam 1992 rather than The Harshad Mehta Scam.

What is the stock market and the money market?

In a stock market, investors own shares in companies. Companies have earnings. The price-to-earning ratio should tell us what's the proper level for the stock price. Companies do everything they can to increase earnings year over year. The stock market is considered a leading indicator of the economy. Stock markets rise if things are improving and deteriorate when the situation seems to go downhill. It's like a rubber band, it may soar or plunge. A share is sold if the seller thinks it's time to get out, while the buyer thinks it's a good time to get in. Share is one of the equal parts into which a company's capital is divided, entitling the holder to a proportion of the profits. Buy on cannons, sell on trumpets.

The money market refers to trading in very short-term debt investments. At the wholesale level, it involves large-volume trades between institutions and traders. This market is characterized by high liquidity and short maturity. Over-the-counter trading is done in the money market. It is used by participants as a way of borrowing and lending for the short term.

How did it start?

Harshad started out as a jobber in BSE (Bombay Stock Exchange). Jobbers were middlemen who held shares and created market liquidity by buying and selling securities, and matching investors' buy and sell orders through brokers, who were not allowed to make markets. A part of the broker's profit was a jobber's earning. However, Harshad Mehta had big ambitions and bigger dreams. He went on to become a stockbroker and eventually took part in the money market.

What is exactly was The Scam?

Harshad Mehta opened his own consultancy and research analysis Growmore. He was the big bull, always kept the market on a rise. Whichever stock Harshad chose, it rose like a rocket. In the money market, RFD (Ready Forward Deals) is made, where one bank approaches a broker to sell its securities to another bank for money and vice versa. When one bank sells securities, it issues a BR (Bank receipt) to confirm the sale. In RFD the banks had to issue checks in the name of another bank and not an individual. However, this didn't happen in the case of Harshad Mehta, since he was a very reputed broker and the banks issued checks directly to him. Then, Harshad asked for some time to go to another bank and get money against securities and vice-versa. During this time, since checks were in this name, he invested all the bank's money in the stock market. When a bank wanted money for their securities, Harshad went to another bank, took money from them, and gave it to the first bank. He repeated this process and it became a cycle. He started using fake BR to get unsecured loans from banks. Harshad started using this loophole in the system to put all the money from BR and RFD in the stock market. This scam was busted by the Journalist Suchita Dalal.

What is in this series?

Scam 1992: The Harshad Mehta Story is a SonyLIV original Indian Hindi-language crime drama web-series directed by Hansal Mehta. This show reveals how The Scam took place and brought out the loopholes in SEBI (Security and Exchange Board of India). It exhibits the journey of Suchita Dalal's investigation. The impact of Harshard's market control and the scam on the lives of his family, his clients, and the market has been portrayed with great precision. The role of government, the reputation of the CBI, and the involvement of PM during that time- P.V. Narsimha Rao has been probed in detail. The show includes the emotional and physical perspective of not only Harshad Mehta but also his family, employees, clients, the competitors, the government, the RBI, the banks, and the journalist Suchita Dalal.

Rating: 5/5

The real Harshad Mehta

Bibliography:- https://www.thinkadvisor.com/2020/03/20/9-ways-to-explain-the-stock-market-in-laymans-terms/

- https://www.youtube.com/watch?v=0NH1Ez6LtN4

- https://www.investopedia.com/terms/j/jobber.asp#:~:text=What%20Is%20a%20Jobber%3F,Exchange%20prior%20to%20October%201986.&text=They%20held%20shares%20on%20their,not%20allowed%20to%20make%20markets

- https://www.thinkadvisor.com/2020/03/20/9-ways-to-explain-the-stock-market-in-laymans-terms/

- https://www.youtube.com/watch?v=0NH1Ez6LtN4

- https://www.investopedia.com/terms/j/jobber.asp#:~:text=What%20Is%20a%20Jobber%3F,Exchange%20prior%20to%20October%201986.&text=They%20held%20shares%20on%20their,not%20allowed%20to%20make%20markets

Nice👌

ReplyDelete